Houston’s real estate market is booming, and its luxury sector is no exception. With a growing population, a thriving economy, and diverse neighborhoods, Houston offers lucrative high-end opportunities. For investors eager to break into Houston’s luxury real estate market, hard money loans can be a game-changer. Why Invest in Houston’s Luxury Real Estate? Houston’s luxury real… Read More »Investing in Houston’s Luxury Real Estate Market with Hard Money Loans

Houston’s thriving real estate market offers endless opportunities for investors, particularly those involved in property rehabs. From revitalizing neighborhoods to increasing property values, rehabs can be highly rewarding. However, even the best-planned projects can face unexpected rehab costs. Managing these surprises effectively is essential to protect your profits and ensure the project stays on track.… Read More »How to Handle Unexpected Rehab Costs in Houston Real Estate Projects

Houston, Texas, often called the Energy Capital of the World, is home to a thriving oil and gas industry that significantly influences the city’s real estate market. For investors looking to capitalize on opportunities in this dynamic region, understanding the interplay between the energy sector and real estate is essential. Whether you’re an experienced investor… Read More »How Houston’s Oil and Gas Industry Impacts Real Estate Investment

Houston, Texas, often touted as the “city with no zoning,” has a reputation for its flexibility in land use. This perceived lack of zoning regulations has been a double-edged sword for real estate investors. While the absence of conventional zoning laws offers opportunities for creative development, the city’s unique regulatory environment introduces challenges that demand… Read More »How Houston Zoning Laws Affect Real Estate Investors

renovations and advice that can help maximize ROI on fix-and-flip projects

Houston’s dynamic real estate market offers numerous opportunities for investors, from house flipping to rental property acquisitions. Hard money loans, known for their speed and flexibility, are often the go-to financing option for investors looking to capitalize on time-sensitive deals. However, to secure funding swiftly and confidently from lenders like Priority Investor Loans, preparation is… Read More »How to Prepare for a Successful Hard Money Loan Application in Houston, Texas

Houston, Texas, one of the fastest-growing metropolitan areas in the United States, offers an exciting array of opportunities for real estate investors. From revitalizing historic neighborhoods to capitalizing on new developments, Houston’s dynamic market makes it a hotspot for savvy investors. Hard money loans, offered by companies like Priority Investor Loans, provide a unique and… Read More »Creative Strategies for Using Hard Money Loans in Real Estate: Unlocking Opportunities in Houston

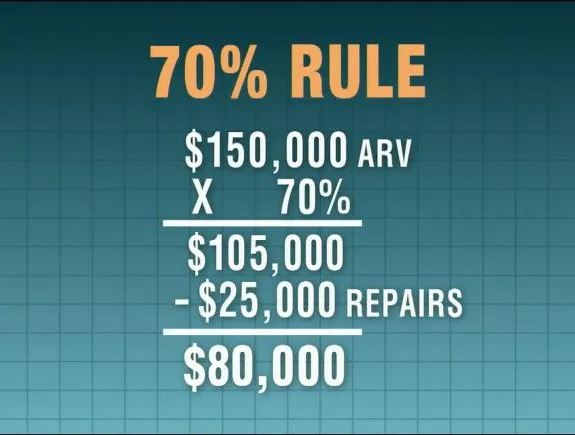

Flipping houses can be an exciting and profitable venture, especially in a thriving market like Houston, Texas. But with the market’s potential rewards come significant risks, making it essential for investors to make data-driven decisions. One of the most popular formulas used by experienced investors to guide these decisions is the 70% rule. This rule… Read More »The 70% Rule in House Flipping: A Guide for Houston Investors

For investors navigating the Houston real estate market, hard money lending can offer a practical alternative to traditional financing. Hard money loans, often favored by property investors due to their quick processing and flexibility, are typically backed by the property itself rather than the borrower’s credit history. At the core of every hard money loan,… Read More »The Process of Loan Underwriting in Hard Money Lending: A Guide for Investors

In Houston’s thriving real estate market, flippers have the opportunity to capitalize on undervalued properties and transform them into profitable investments. However, one of the biggest challenges facing real estate flippers is securing the capital to fund their projects. This is where hard money lending steps in, offering a quick, flexible solution to bridge the… Read More »Hard Money Lending for Real Estate Flippers in Houston: Fueling Your Next Project

Crafting a diversified investment portfolio is essential for professionals seeking both robust returns and risk mitigation. Unlike traditional forms of real estate investment, hard money loans provide a shorter-term, asset-backed approach that demands a nuanced strategy. This article explores key strategies for professionals looking to build a diversified hard money real estate portfolio, thereby spreading… Read More »Diversifying Your Real Estate Portfolio: Strategies with Hard Money Loans

For professionals seeking quick and flexible financing solutions, hard money lenders are an invaluable source of opportunity in the real estate industry. While these lenders offer a lifeline for those looking to seize lucrative opportunities, navigating the terrain requires caution. In this article, we’ll shed light on common mistakes professionals make when borrowing from hard… Read More »Common Mistakes to Avoid When Borrowing from Hard Money Lenders

In the world of real estate financing, informed professionals recognize the importance of staying ahead of the curve to optimize opportunities. One intriguing strategy that has gained prominence in hard money lending is cross-collateralization. For borrowers aiming to secure larger loan amounts, understanding the concept and potential benefits of cross-collateralization is crucial. Cross-Collateralization Demystified: Cross-collateralization… Read More »Maximizing Loan Potential: The Power of Cross-Collateralization in Hard Money Lending

Hard money loans have become a popular choice for savvy professionals seeking quick and flexible funding. However, within the terms and conditions of these loans are a crucial factor that borrowers should carefully consider – prepayment penalties. Understanding the concept of these penalties and their potential impact on borrowers is essential for making informed financial… Read More »Navigating Prepayment Penalties in Hard Money Loans

Securing financing for real estate investments can be a daunting task, especially when traditional lenders hesitate due to credit history or complex projects. In such scenarios, hard money lenders are valuable allies, providing quick and flexible funding solutions. However, the key to obtaining approval lies in presenting a convincing loan proposal that showcases the strengths… Read More »A Guide to Crafting a Hard Money Loan Proposal

Securing funding can make all the difference between seizing a lucrative opportunity or missing out in real estate. Hard money lending has emerged as a powerful financial tool that real estate developers can leverage to streamline land acquisitions, secure construction financing, and ensure the successful completion of their projects. In this article, we will explore… Read More »Success in Real Estate Development with Hard Money Loans

Real estate professionals, with their intricate knowledge of the property market, often contemplate various avenues to diversify their portfolios. One such avenue that has gained popularity in recent years is house flipping. This article aims to explore whether flipping houses is the right choice for professionals in the real estate industry, considering the unique challenges… Read More »House Flipping: Is it the Right Move for Your Real Estate Venture?

Real estate professionals are constantly seeking innovative and lucrative investment opportunities. One such avenue gaining traction is hard money lending for unique investment opportunities. This strategy involves providing short-term loans secured by real estate, catering specifically to niche markets. In this article, we will explore the potential of hard money lending in unique investment realms,… Read More »Hard Money Lending for Unique Investment Opportunities

In the realm of real estate investment, timing is of utmost importance. The ability to swiftly seize opportunities in fast-paced markets can be the difference between success and stagnation. In such competitive landscapes, where traditional financing may not keep pace with the speed of transactions, hard money loans play a crucial role in empowering real… Read More »A Competitive Edge for Real Estate Investors

In hard money lending and real estate, where financial deals pivot on swift decisions and reliable partnerships, the adage “it’s not just what you know, but who you know” is particularly true. The power of networking within this domain is not just a buzzword. It’s a crucial factor that can significantly impact the success and… Read More »The Necessity of Networking in Hard Money Lending

Real estate investment has always been a lucrative avenue for those seeking to build wealth over the long term. Among the various strategies employed by investors, the fix-and-hold approach is a reliable method for generating consistent rental income. However, financing the purchase and renovation of properties for this purpose often requires creative solutions. Enter hard… Read More »Leveraging Hard Money Loans for Fix-and-Hold Strategies

In the intricate world of finance, the maxim “location, location, location” extends beyond real estate transactions. Specifically, in hard money lending, the geographical location of a property holds substantial sway over lending decisions. The impact of location on hard money lending decisions is a multifaceted and intricate landscape that directly influences how lenders assess risks… Read More »The Crucial Role of Location in Hard Money Lending

The symbiotic relationship between market trends and hard money lending is an essential and captivating aspect of the real estate market. The confluence of economic conditions, shifts in market dynamics, and evolving borrower strategies creates a dynamic landscape that significantly influences the domain of hard money lending. Hard money lending, often regarded as a pragmatic… Read More »The Dynamic Relationship Between Market Trends and Hard Money Lending

In the world of hard money lending, where speed and flexibility are paramount, property appraisal takes center stage. This article unravels the nuances of property appraisal in the context of hard money loans, shedding light on the unique process that distinguishes it from traditional appraisals. Understanding the Essence of Property Appraisal in Hard Money Lending… Read More »The Intricacies of Property Appraisal in Hard Money Lending

Hard money loans are a valuable resource for both borrowers and lenders seeking to seize opportunities and make profitable investments due to their quick access to capital. However, the interest rates on hard money loans play a pivotal role in determining the affordability and viability of these financial instruments. In this article, we will explore… Read More »The Impact of Interest Rates on Hard Money Loans

In the world of real estate and property investment, the term “hard money loan” often stirs up a whirlwind of misconceptions and myths. As professionals in the field, it’s imperative to distinguish reality from fiction when it comes to this unique financing option. In this article, we will set the record straight by debunking some… Read More »Debunking Myths About Hard Money Loans

In the world of real estate and business investments, securing the right financing is often the cornerstone of success. When it comes to financing options, two prominent choices stand out: Hard Money Loans and Traditional Bank Loans. Each of these financing methods has its unique advantages and drawbacks, making it crucial for professionals to understand… Read More »Hard Money Loans vs. Traditional Financing

As the landscape of real estate and entrepreneurship continue to evolve, hard money loans act as a principal source of funding for a wide range of projects and industries. Their unique characteristics make them especially appealing to professionals seeking rapid access to capital for diverse ventures. In this article, we will explore the top industries… Read More »Top Industries and Projects Funded by Hard Money Loans

The real estate market is dynamic and ever-changing, and its growth is often fueled by the availability of financing options. In recent years, hard money lenders have become key figures in this industry. They play a vital role in facilitating real estate market expansion, particularly for small-scale developers and investors. In this article, we will… Read More »The Role of Hard Money Lenders in Real Estate Market Growth

In the high-stakes world of real estate, hard money loans provide a swift and flexible means of financing that frequently open the doors to lucrative real estate opportunities. However, the path to a successful hard money loan agreement is not just about numbers; it’s about the negotiation. Whether you’re a borrower seeking favorable terms or… Read More »Mastering the Deal: Negotiation in Hard Money Lending

In the fast-paced world of real estate, hard money loans have emerged as a lifeline for investors seeking quick and flexible financing. These loans, while invaluable, come with their fair share of risks. Hard money loans, typically short-term and collateralized by the property, often carry higher interest rates than traditional loans. This makes them attractive… Read More »A Guide to Mitigating Hard Money Loan Risks

In the world of real estate investment, hard money loans have emerged as a crucial tool for funding projects with speed and flexibility. These short-term, asset-based loans offer investors the financial leverage they need to seize real estate opportunities, but they come with a critical caveat: the need for a well-crafted exit strategy. In this… Read More »The Art of Exit Strategies: Ensuring On-Time Repayment of Hard Money Loans

The Essence of LTV Ratios The Loan-to-Value ratio reflects the proportion of a loan amount compared to the appraised value of the collateral property. In other words, it quantifies the risk undertaken by the lender in relation to the property’s value. Hard money lenders use LTV ratios as a primary criterion when determining the maximum… Read More »Loan-to-Value Ratios: The Core of Hard Money Lending

When applying for a hard money loan, borrowers need to understand the criteria that hard money lenders consider during the evaluation process. In this blog post, we will provide insights into the evaluation factors that influence a borrower’s eligibility for a hard money loan. Value of the Property Hard money lenders primarily focus on the… Read More »Qualifying for a Hard Money Loan: Insights into Evaluation Criteria

Traditional financing may not always be the best solution for every real estate investment endeavor. In this blog, we will explore situations where traditional financing may not be feasible and when to consider hard money loans as an alternative option. By understanding these situations, readers can make informed decisions about if a hard money loan… Read More »Exploring Alternative Financing Options: When to Consider a Hard Money Loan

When considering hard money loans, it’s essential to understand the associated costs involved. In this blog, we will break down the various costs typically associated with hard money loans. Origination Fees Origination fees are charges imposed by the lender to cover the costs of processing the loan. They are usually calculated as a percentage of… Read More »Understanding the Costs of Hard Money Loans: Analyzing Fees for Informed Financing

Obtaining a hard money loan can be a valuable financing option for real estate investors, but understanding the application process is essential. In this blog, we will provide a detailed step-by-step guide to help potential borrowers navigate the hard money loan application process and know what to expect. From gathering necessary documents to working with… Read More »Navigating the Application Process: Step-by-Step Guide to Obtaining a Hard Money Loan

Houston, Texas has a dynamic and thriving real estate market with a diverse range of opportunities. Whether you’re looking to buy or sell a property in Houston, understanding how to navigate this market is essential. In this guide, we’ll provide you with valuable tips and insights to help you successfully navigate the real estate market… Read More »Successfully Navigate Real Estate in Houston, TX

Establishing a successful and long-term relationship with hard money lenders is essential for your real estate projects. In this blog, we will provide tips and best practices to foster a positive and mutually beneficial partnership with hard money lenders. By following these suggestions for effective communication, timely payments, transparency, and demonstrating a solid business plan,… Read More »Building Trust with Hard Money Lenders

Real estate investment is a popular wealth-building strategy that offers numerous benefits and opportunities. Whether you’re a seasoned investor or considering your first venture into real estate, understanding the advantages of this asset class is essential. In this comprehensive guide, we will explore the benefits of investing in real estate and highlight why it can… Read More »Benefits of Investing in Real Estate

Real estate investing offers various strategies for generating profits and building wealth. Two popular approaches are fix and flip and buy and hold. In this blog, we will compare these two strategies, examining their benefits, considerations, and potential risks. By understanding the differences between the fix and flip and buy and hold strategies, real estate… Read More »Investing in Fix and Flip vs. Buy and Hold

Investing in commercial real estate can offer various benefits, such as potential income generation, asset appreciation, and diversification. However, it’s essential to consider several key factors before making such investments. Here are seven key considerations to keep in mind when investing in commercial real estate: 1. Location The location of a commercial property plays a… Read More »7 Considerations for Commercial Real Estate

Understanding real estate market cycles is crucial for making profitable investments. The real estate market is known for its cyclical nature, with periods of expansion, peak, contraction, and trough. By recognizing these cycles and adapting investment strategies accordingly, investors can increase their chances of success. Here are some key concepts to understand when it comes… Read More »Understanding Real Estate Market Cycles

Due diligence is an important process in real estate investments that involves conducting thorough research, analysis, and investigation before finalizing a transaction. It allows investors to gather relevant information, assess risks, and make informed decisions about the property and the investment. Here are some key reasons why it is important in real estate investments: Assessing… Read More »Importance of Due Diligence in Real Estate

When it comes to assessing the potential of a real estate investment, a hard money lender’s perspective can provide valuable insights. In this blog post, we will share tips and guidance on how to evaluate the viability and profitability of a real estate investment. By considering these factors, investors can make informed decisions and maximize… Read More »Hard Money Lenders Perspective

In the world of real estate investing, there’s a wealth of opportunities for savvy investors who specialize in fixing and flipping homes. However, what if you’ve found a property with the potential to become a profitable rental? Acquiring financing for such projects can be a challenge, especially for investors who are new to the game.… Read More »Hard Money Loans for Rental Properties

Real estate investing has long been a lucrative venture. Specifically, fix and flip projects have gained significant popularity among seasoned and aspiring investors alike. However, undertaking a successful fix and flip project requires adequate financing, which can be challenging to secure through traditional means. This is where fix and flip loans come into play. They… Read More »Fix and Flip Loans: A Game Changer

In real estate development and investment, access to capital is crucial for turning ambitious visions into tangible reality. Commercial loans have emerged as a lifeline for developers and investors. They provide the necessary financial resources to embark on ambitious projects, seize opportunities, and achieve long-term growth. In this blog post, we will explore the significant… Read More »Commercial Loans: Real Estate

Real estate investment has long been considered a lucrative avenue for generating wealth and securing financial stability. However, for many aspiring investors, the initial capital required to purchase properties can be a significant barrier. This is where landlord loans come into play, providing an effective financing solution tailored specifically for real estate investors. In this… Read More »The Benefits of Landlord Loans

Meet Hard Money Lender Ethan McCarron. If You want to get into real estate investing and need more money to fund your flips this will be a great podcast episode for you.

If you’re a real estate investor with some experience in the industry, chances are you’ve heard of hard money lenders. These lenders provide short-term, high-interest loans that are secured by real estate. This makes them a popular choice for investors who need quick access to cash. In this blog, we’ll take a closer look at… Read More »Understanding Private Money Loans

If you have an interest in real estate investing, you may have heard of the term “fix and flip.” This refers to the process of buying a property that needs some repairs or renovations, fixing it up, and then selling it for a profit. It can be a lucrative investment strategy if done correctly, but… Read More »Fix and Flip Loans for Investment Properties

Real estate is one of the most lucrative investment opportunities out there, but it can also be a risky venture. To succeed in real estate investing, you need to have access to capital. One way to secure financing for your real estate investments is through hard money loans. Hard money loans are a type of… Read More »Understanding Real Estate Loans

Real estate investing can be a profitable venture. Beginners often face challenges when they start real estate investing, particularly if they lack the funds to buy a property outright. This is where hard money loans come in. Unlike traditional loans, which rely on a borrower’s creditworthiness and income, hard money loans rely on the value… Read More »Real Estate Investing with Hard Money Loans

When traditional lending institutions like banks and credit unions are unable or unwilling to provide funding, hard money lenders can be a valuable resource. Hard money lenders are private individuals or companies that provide short-term, high-interest loans secured by real estate. In this blog, we will discuss what hard money lenders are, how they work,… Read More »Understanding Hard Money Lenders

Bridge financing represents a short-term funding type employed to bridge the gap between two financial transactions. Usually, businesses or individuals resort to this financing when they need to cover expenses or make a purchase but lack available funds. Bridge financing can be a valuable tool for businesses or individuals who need quick access to cash.… Read More »Types of Bridge Financing

A bridge loan is a short-term financing solution that can be useful for real estate investors who need quick access to cash for purchasing or renovating a property. Bridge loans serve to “bridge” the gap between purchasing a new property and selling an existing one. They can also be used to fund property enhancements that… Read More »Bridge Loan Strategies for Investors

Before applying for a hard money loan, it’s important to research lenders in your area with lots of experience. Lenders have the tools to evaluate the risk of your venture and offer guidance on achieving success with your loan. They may also be able to offer more favorable terms than those provided by traditional bank… Read More »Researching Hard Money Lenders

If you’re considering applying for a hard money loan in 2023, here are some steps you can take to increase your chances of approval: Understand the Risks and Benefits Before applying for any type of loan, it’s important to understand the potential risks and benefits. Hard money loans can offer several advantages, such as faster… Read More »How to Get a Hard Money Loan in 2023

It’s important to understand the pros and cons of a hard money loan before making a decision. On the plus side, receiving funds is pretty straightforward since credit scores and income requirements are often lower than what a bank loan requires. Hard money loans also tend to come with more flexible repayment terms. However, hard… Read More »Pros and Cons of a Hard Money Loan

Before buying an investment property, there are several key things you should know and consider. These include: The type of property: Different types of properties, such as single-family homes, multifamily buildings, and commercial properties, have different investment potential, risks, and returns. It’s important to choose a property type that aligns with your investment goals and… Read More »Buying an Investment Property?

Before you decide to take out a hard money loan in Houston TX, there are several questions you should ask yourself and the lender. This guide will help you understand what conditions you need to meet to qualify for a loan and what to look out for. How much of a down payment do I… Read More »Ask Before Applying for Hard Money Loans

Real estate investors frequently utilize hard money loans, which rely on the collateral value of the property. But what exactly makes hard money loans unique? In this blog, we will go over the basis of what a hard money loan is, and some of its most compelling attributes. Real estate investors frequently turn to hard… Read More »What is a hard money loan?

Marketing is an important aspect of real estate investing because it helps investors reach potential buyers and sellers, as well as generate leads for new investment opportunities. Effective marketing can help investors build their brand, establish themselves as experts in their market, and differentiate themselves from their competitors. Real estate investors can use a variety… Read More »Importance of Marketing for Real Estate Investors

Real Estate Investing Terms Appreciation: This refers to the increase in the value of a property over time. Cap rate: The capitalization rate is a measure of the rate of return on a real estate investment property. Calculate it by dividing the property’s net operating income by its current market value. Cash flow: Cash flow… Read More »Top 10 Real Estate Investment Terms

Create a detailed business plan: A business plan is a roadmap that outlines your goals, strategies, and tactics for achieving success in your real estate investing ventures. It should include a detailed budget, cash flow projections, and a plan for marketing and selling properties. Diversify your portfolio: Real estate investing is risky, so it’s important… Read More »5 Financial Tips for Real Estate Investing

Hard money loans are a type of financing that is often used by real estate investors. These loans are typically based on the value of the property being purchased, rather than the borrower’s creditworthiness. There are several benefits to using hard money loans for real estate investing, including the following: Quick Funding Hard money loans… Read More »Benefits of Hard Money Loans

Rental property loans are decided based on multiple factors such as having enough cash for a down payment, qualifications for government loans and the amount the buyer can afford for the property’s monthly cost. Hard money lends are specifically able to help make a rental property purchase more successful.

Fixing and flipping homes is a great investment opportunity where there is a lot of opportunity for people to buy less expensive homes. The process allows rehabs to be completed quickly

The 70% rule is an investment strategy in real estate to help an investor take on less risk, but still make money. This strategy has been very successful for other fix and flip investors in making profitable borrowing decisions

Before you jump into a hard money loan investment, it’s important to note a few key aspects that will make the process much smoother. It will be beneficial to do your research beforehand on what to expect in terms of the hard money process. It’s important to have a clear understanding of the loan you’re… Read More »Before Getting a Hard Money Loan

For those in the Houston area, getting funding for properties can sometimes be a challenge. Maybe you don’t have time to wait and go through the entire process of applying for a typical loan or maybe you just have no idea where to start. Hard money loans are conventionally based on the value of said… Read More »Hard Money Lenders in Houston

We understand you may be on the fence about whether or not to invest in a hard money loan. Is it a good idea? Right from the beginning, it’s good to know there are various advantages of hard money loans. In comparison to other loans, the process of obtaining funding for a hard money loan is… Read More »4 Advantages of Hard Money Loans

Before you look around for a hard money loan, it’s important to consider what factors play into pre-approval. Private lenders want to ensure that you will be acting as a reliable investor in the future. In this blog, we will highlight characteristics and details that will demonstrate why you should be pre-approved for a loan.… Read More »Must-Know Tips for Loan Pre-Approval

Are you wondering if you should close on an upcoming deal? Not sure if you’re making the right decision? Make sure to consider the After Repair Value (ARV). ARV is the property’s value after upgrades and renovations. Knowing this in the beginning will let you know if the deal you’re pursuing is worth it. Not… Read More »When to Think About After Repair Value (ARV)

What makes a hard money loan unique? They are those backed by real, hard assets, also known as tangible property. Tangible properties are used as collateral, which is then used to repay the hard money loans in a timely manner. Also referred to as a type of bridge loan, hard money loans are short-term investments… Read More »What Exactly is a Hard Money Loan?

Sometimes, the process for obtaining hard money loans can be a little… confusing. But no worries, we here at Priority Investor Loans have your back! Here are some crucial tips and tricks to guarantee an easy loan acquisition. Understanding the Loan: Be sure to know exactly what you are asking for. What does that mean?… Read More »Essential Checklist for Hard Money Loans

Always remember that hiring a good general contractor plays a huge part in the success of your real estate project. Not sure how to find one that is reliable? What kinds of questions do you ask? How do I know if I am getting a good price? As always, Priority Investor Loans (PIL) is here… Read More »6 Tips for Finding a General Contractor

"Jack Blythe is a pleasure working with. Jack ensured that I was updated throughout the closing of my deal. His thoroughness, professionalism, communication and attention to detail are exemplary and gave me assurances for the success of the closing of my investment property and indeed it was a success. If I can give more than 5 stars, I would."

Shaolin Preacher

Investor"Priority investor loans and Jack the investment officer helped me purchase two homes and rent them out. They explained everything I had questions on and even helped me find homes in my budget. I will be using them again. The have knowledge on many loan types and the best one that will reach your goals. If your looking to finance something call them and let them explain everything to you. They are the best!!!"

Ashton Ricks

Investor"Jack has helped me now with 2 deals and am very impressed with his professionalism and quick response times. He really tries hard to help and make the deals happen if they make sense. Looking forward to closing more deals with Jack in the coming months."

Marcela Amador

Investor"Jack Blythe is a pleasure working with. Jack ensured that I was updated throughout the closing of my deal. His thoroughness, professionalism, communication and attention to detail are exemplary and gave me assurances for the success of the closing of my investment property and indeed it was a success. If I can give more than 5 stars, I would."

Shaolin Preacher

Investor"Priority investor loans and Jack the investment officer helped me purchase two homes and rent them out. They explained everything I had questions on and even helped me find homes in my budget. I will be using them again. The have knowledge on many loan types and the best one that will reach your goals. If your looking to finance something call them and let them explain everything to you. They are the best!!!"

Ashton Ricks

Investor"Jack has helped me now with 2 deals and am very impressed with his professionalism and quick response times. He really tries hard to help and make the deals happen if they make sense. Looking forward to closing more deals with Jack in the coming months."

Marcela Amador

InvestorRecent Posts

Categories

- Advice 73

- Fix & Flip 6

- Podcast 1

- Rentals 1

- Uncategorized 0

- Videos 0